Time and again we read about how much a Porsche Carrera GT, for example, has increased in value. Or that driving an 911 is virtually free because they increase in value so much anyway. But can a Porsche sports car really make you money? Can it be a good investment? Can a Porsche 911 really generate a profit on sale after all costs have been deducted? And how does a sports car perform as an investment compared to other asset classes? We’ve done the math for you and compared a few scenarios.

To compare different investment options and ultimately profits, all costs must be taken into account. In our example, this means that we have to add up all costs incurred by keeping and operating the vehicle during the holding period. That is: purchase price, financing costs, depreciation (or appreciation), maintenance, repairs, insurance, taxes, storage, vehicle care, accessories, modifications and, of course, fuel. This gives the so-called total cost of ownership, or TCO for short. They are the basis for calculating the profit.

| Porsche 964 Carrera 2 | Porsche Carrera GT | |

|---|---|---|

| tax | 264 € | 391 € |

| insurance | 1,000 € | 5,000 € |

| fuel (5.000/ 2.000 km p.a.) | 891.71 € | 594.48 € |

| storage | 1,200 € | 3,600 € |

| yearly inspection | 500 € | 5,000 € |

| minor inspection | 1,600 € | 15,000 € |

| major inspection | 2,500 € | 30,000 € |

| tires | 140 € | 400 € |

| vehicle care | 200 € | 200 € |

| modifications | 500 € | 1,000 € |

| repairs | 1,000 € | 5,000 € |

In our thought experiment we look at a 1991 Porsche 964 Carrera 2 and a 2005 Carrera GT. Both purchased in 2013, holding period ten years. Of course, financing costs in particular are extremely dependent on personal economic circumstances and the type of financing chosen. It is impossible to calculate all conceivable scenarios here. We have therefore based our calculations on two options for each of the two vehicles.

The first option is simply cash payment. Secondly, we will take financing with a 48 or 96-month term, 4.99% interest rate and constant rate with no residual debt as the basis. Personal contract purchase or hire purchases are also a common choice, but will not be considered here. The primary purpose of this example is to provide a trend of what impact financing will have on the bottom line.

| 964 C2 cash paid | 964 C2 on finance | Carrera GT cash paid | Carrera GT on finance | |

|---|---|---|---|---|

| purchase price 2013 | 40,000 € | 40,000 € | 350,000 € | 350,000 € |

| down payment | – | 20,000 € | – | 100,000 € |

| interest rate | – | 4.99 % | 4.99 % | |

| monthly payment | – | 48 à 469.91 € | – | 96 à 3,222.07 € |

| total purchase price | 40,000 € | 42,555.68 € | 350,000 € | 409,318.72 € |

| selling price 2023 | 110,000 € | 110,000 € | 1,250,000 € | 1,250,000 € |

Logically, these calculations must also be made for the comparative investment. The possibilities to invest (and speculate) on the capital market are almost infinite. Here, all conceivable stocks, bonds, foreign currencies and the like could be used as a comparison object. The fairest option is probably the market itself.

Fittingly, there is a good option for this in the capital market. It’s called exchange-traded funds (ETFs). This form of investment is also referred to as a passive investment style. Why? Because an ETF tracks a certain index. This requires significantly less intervention and corrections by the fund management. Therefore, the running costs are lower than for actively managed funds. In our calculation example, we assume these to be 0.25% of the investment sum.

We choose the MSCI World Index for our comparative calculation. This index comprises the largest companies by market capitalization of the 23 biggest industrialized nations. In total, more than 1,600 exchange-traded companies are included in the index. Funds that track the MSCI World Index are considered the standard recommendation for passive investors. In 1975, the index was launched and developed with an average annual return of about +9%.

Now, in order to compare apples with apples, we also have to consider two options for this kind of investment. On the one hand, the one-time investment in the same amount as the purchase price of the car. For comparison with the financed car, the initial securities purchase is the same as the down payment for the car. We have assumed the installment then payable on financing as the savings rate for the equity fund.

As Benjamin Franklin already knew, taxes are as certain as death. This also applies to profits from speculating on the stock market. These are subject to capital gains tax. For this purpose, we have assumed the German flat rate of 25%. In the USA, it depends on your personal tax rate, for comparison. The situation is very complicate for the private sale of motor vehicles. If profits are generated here, they are generally tax-free in Germany. However, in the USA the sales tax on used cars can be anything from 0,00% to 7,5%! They vary from state to state, so we have not applied any sales tax in our calculations. Therefore, do your diligence beforehand!

A decade ago, the price structure for Porsche 964 Carreras looked significantly different. As a benchmark for a good 964 C2 anno 2013 we can assume 40,000 euros. We also assume an annual mileage of 5,000 km. In our example, this means seven annual inspections with oil changes, one minor and one major service, at 500, 1,600 and 2,500 euros.

Other yearly costs include an annual insurance premium of 1,000 euros, vehicle tax of 264 euros, fuel costs of just under 900 euros, 500 euros per year for modifications and an annual repair budget of 1,000 euros. The calculation is completed by 100 euros in monthly storage costs, 200 euros annually for car care (e.g. washing), two sets of rear tires at 500 euros each, and one set of fronts at 400 euros. Sure, everyone has a different standard for maintaining a vehicle, but we assume exemplary care.

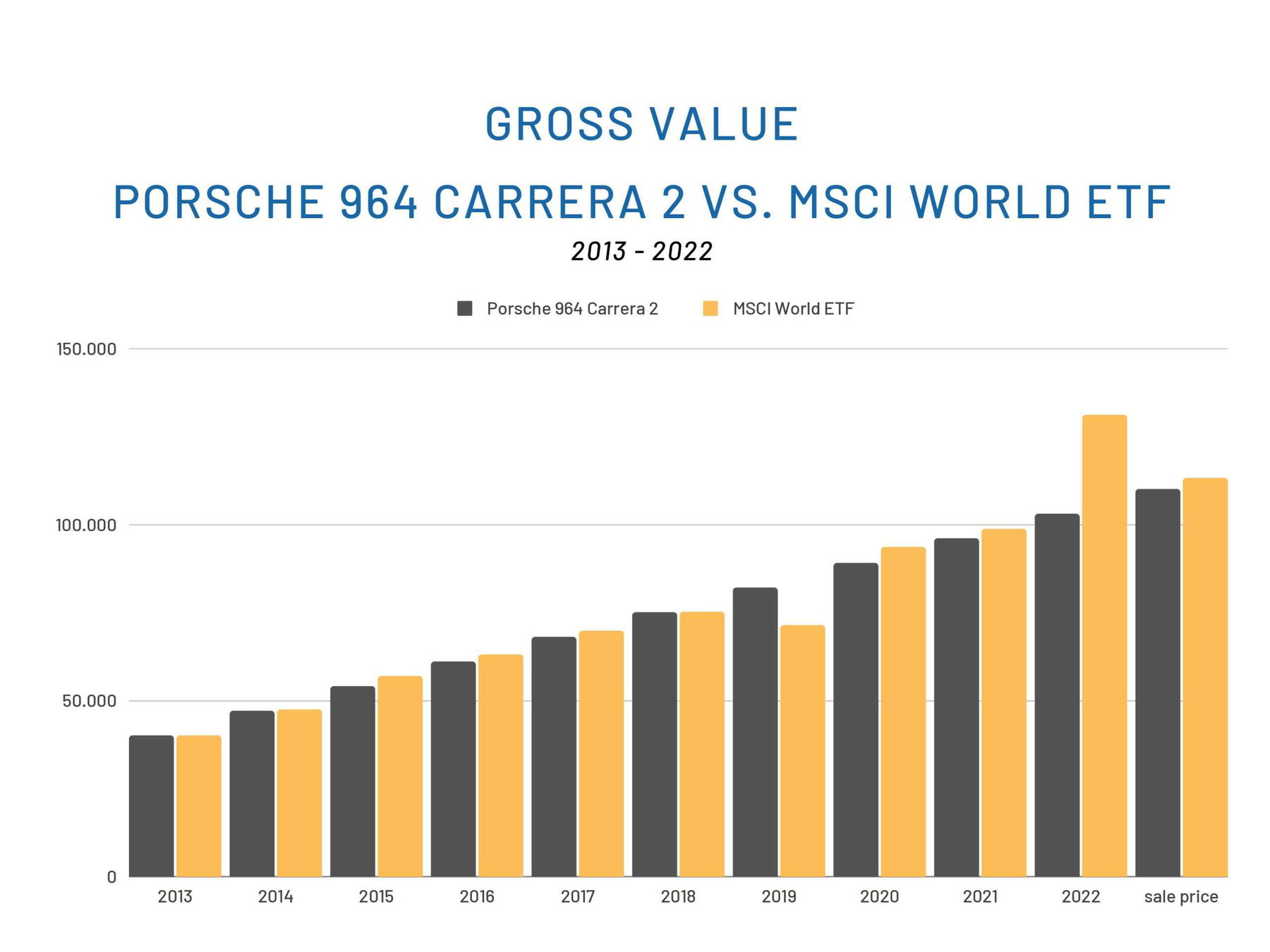

So if you bought a manual Porsche 964 Carrera 2 in cash in 2013, in our example you would end up with total expenditure of 88,657.14 euros. Financed with a 20,000 euro down payment and 48 monthly installments of just under 470 euros, the bottom line is 91,212.85 euros. This compares with a current vehicle value of around 110,000 euros.

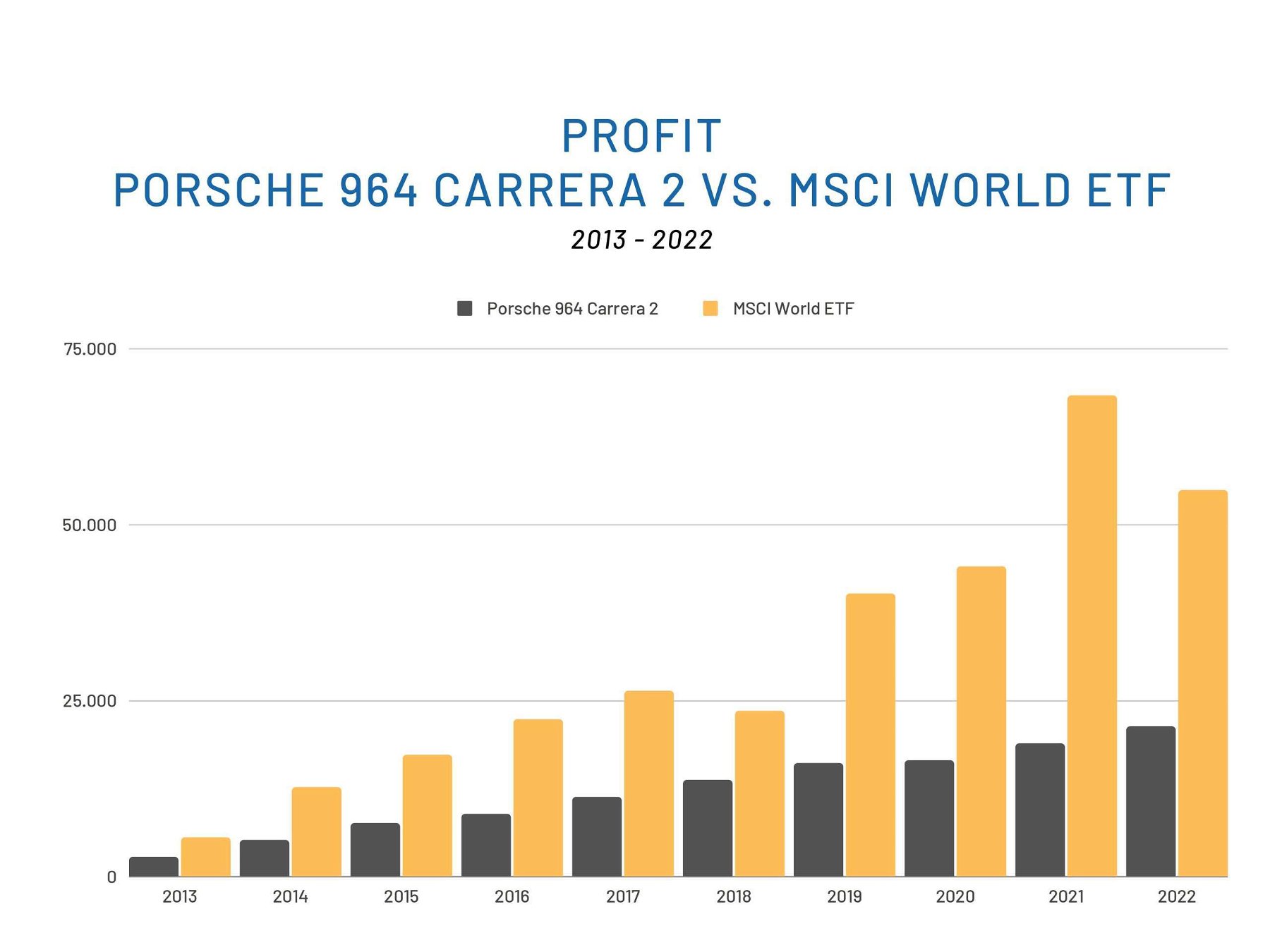

If we’ve done our maths correctly, this means 21,342.86 euros or 18,787.15 euros profit after deduction of all costs. So, can a sports car really earn money? The answer to this is: Yes, it can – if nothing unforeseen happens. But bare in mind: This calculation is subject to a very high risk. An engine failure would immediately turn the calculation into the red.

| Porsche 964 Carrera 2 cash paid | Porsche 964 Carrera 2 on finance | |

|---|---|---|

| Average cost per year (including purchase price 2013) | 8,865.71 € | 9,121.28 € |

| TCO for 10 years | 88,657.14 € | 91,212.85 € |

| selling price 2023 | 110,000.00 € | 110,000.00 € |

| profit | 21,342.86 € | 18,787.15 € |

And how does this compare to a stock portfolio? Well, here you have to admit (unfortunately) that the your typical investment in the stock market is clearly ahead. With the same one-time investment of 40,000 euros, investors received a profit of 54,813 euros after deducting all costs and 25% taxes. With a one-time payment of 20,000 euros and a subsequent monthly savings installment of 470 euros over 48 months, the figure is still 48,370.96 euros. While the value of the portfolio and the car are roughly correlated, the TCO clouds the picture to the Porsche’s disadvantage.

Our little experiment shows that even if a Porsche sports car more than doubles in value over ten years, it may generate a profit but will lose out to a share investment by quite some margin. However, in the case of a share portfolio, the emotional return in the form of driving pleasure is omitted. It is, of course, up to each individual to decide how high this is valued in the personal cost-benefit calculation.

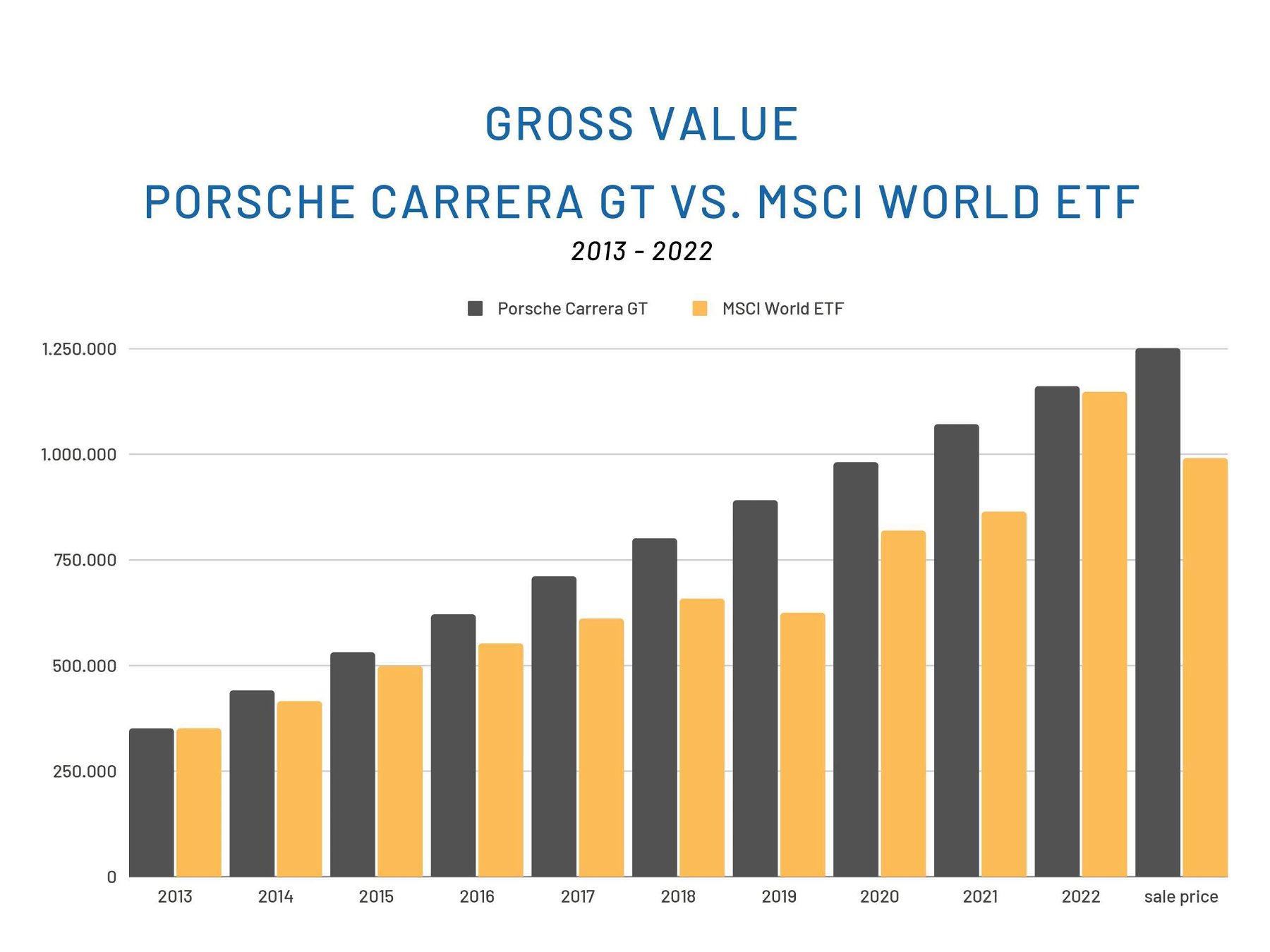

This very theoretical comparison can also be applied to super sports cars like the Porsche Carrera GT. However, it is much more difficult to estimate the TCO. The purchase price in 2013 is around 350,000 euros. Assuming a suitable condition, the current value is closer to 1,250,000 euros. As a financing example, we assume a down payment of 100,000 euros and 96 monthly installments of 3,222.07 euros.

Really complex becomes the calculation of the cost of service, tires, repairs and so on. Here we can only make a vague approximation. Defects on a Porsche Carrera GT can very quickly cause astronomical costs. We calculate with the following assumptions: 2,000 kilometers per year, again seven annual inspections as well as one major and one minor service (5,000/15,000/30,000 euros). In addition, 300 euros per month for storage, 5,000 euros in annual insurance premiums, 400 euros per year for tires and over the entire ten years 10,000 euros for mods. To have a safety cushion, we also count in 50,000 euros for repairs.

We were quite surprised by the result. Regardless of the form of financing, the Porsche Carrera GT not only generated a handsome return. What’s more, the profit was even higher than the MSCI World ETF investment of the same amount. The stock portfolio with an investment of 350,000 euros in 2013 yields a profit of almost 480,000 euros after costs and taxes. The Carrera GT comes to 691,000 euros over the same ten year period! And that despite annual costs of almost 22,000 euros.

| Porsche Carrera GT cash paid | Porsche Carrera GT on finance | |

|---|---|---|

| Average cost per year (including purchase price 2013) | 55,895.48 € | 61,827.33 € |

| TCO for 10 years | 558,954.76 € | 618,273.31 € |

| selling price 2023 | 1,250,000.00 € | 1,250,000.00 € |

| profit | 691,045.24 € | 631,726.69 € |

We see the same picture in the (highly simplified) financing example. The gap is even wider here. More than 631,700 euros in profit for the Carrera GT are compare to “just” little over 308,000 euros in profit from the share portfolio. That doesn’t read bad at all. And on top of that, you would have had one of the most desirable supercars ever in your garage for ten years.

However, it must be emphasized at this point that this is only an excerpt. It is a calculation that works out because of the Porsche Carrera GT’s unusually steep appreciation over the last decade. Would such a calculation also work for a newly purchased Porsche 992 Carrera? That is highly doubtful.

There is simply no rational answer to this question. The imponderables and also the risks of a total loss are far too great. No one knows how the prices for used and classic Porsche sports cars will develop. Perhaps we will also experience a major slump. And will there perhaps even be a driving ban on cars with combustion engines in the long term? All these factors of uncertainty do not allow any firm conclusion.

That’s why we almost traditionally recommend not buying a car for profit. Instead, the interest, passion and, above all, driving pleasure should be the focus of consideration. However, it is a tempting idea that a hobby could even bring a little profit over the years.

The examples shown above cover two extremes. On the one hand, the spearhead of Porsche sports cars from the 2000s, and on the other, a Porsche 911 base model that is over 30 years old. Both could have turned a profit in our example. Always assuming that no capital damage occurs. Although the monetary profit is only really competitive in one case, the emotional profit is certainly considerably higher than the capital market investment in both.

Perhaps it can be summed up like this: If you drive a classic Porsche sports car, you have at least a small chance of earning a profit. And if it doesn’t turn out that way in the end, the world certainly doesn’t come to an end. Because then at least you’ve had a fantastic sports car for some time and hopefully collected some unforgettable experiences.

And five vehicles that, according to our crystal ball, have a good chance of actually bringing in profits, you can find in our top 5 investment picks for 2023.

Elferspot magazine