As part of our exclusive dealer service, we offer an insight into the Porsche market on Elferspot. This time, the statistical review of the last quarter of 2023 looks at interesting developments regarding Porsche’s oldest models. We take a look at the role that Porsche 356 and 911 F-model still play on the market, even more than 50 years after production ended.

On the one hand, we look at the development of the number of views of vehicle listings for both model series, as well as the average clicks per classified listing on Elferspot. We have also analyzed the average number of days between the creation of the advertisement and its marking as sold. And – of course – there is a deep dive into selected Porsche 356 and 911 F model’s values over the past three years. This much we can say in advance: Interesting trends can be seen in both categories in recent years.

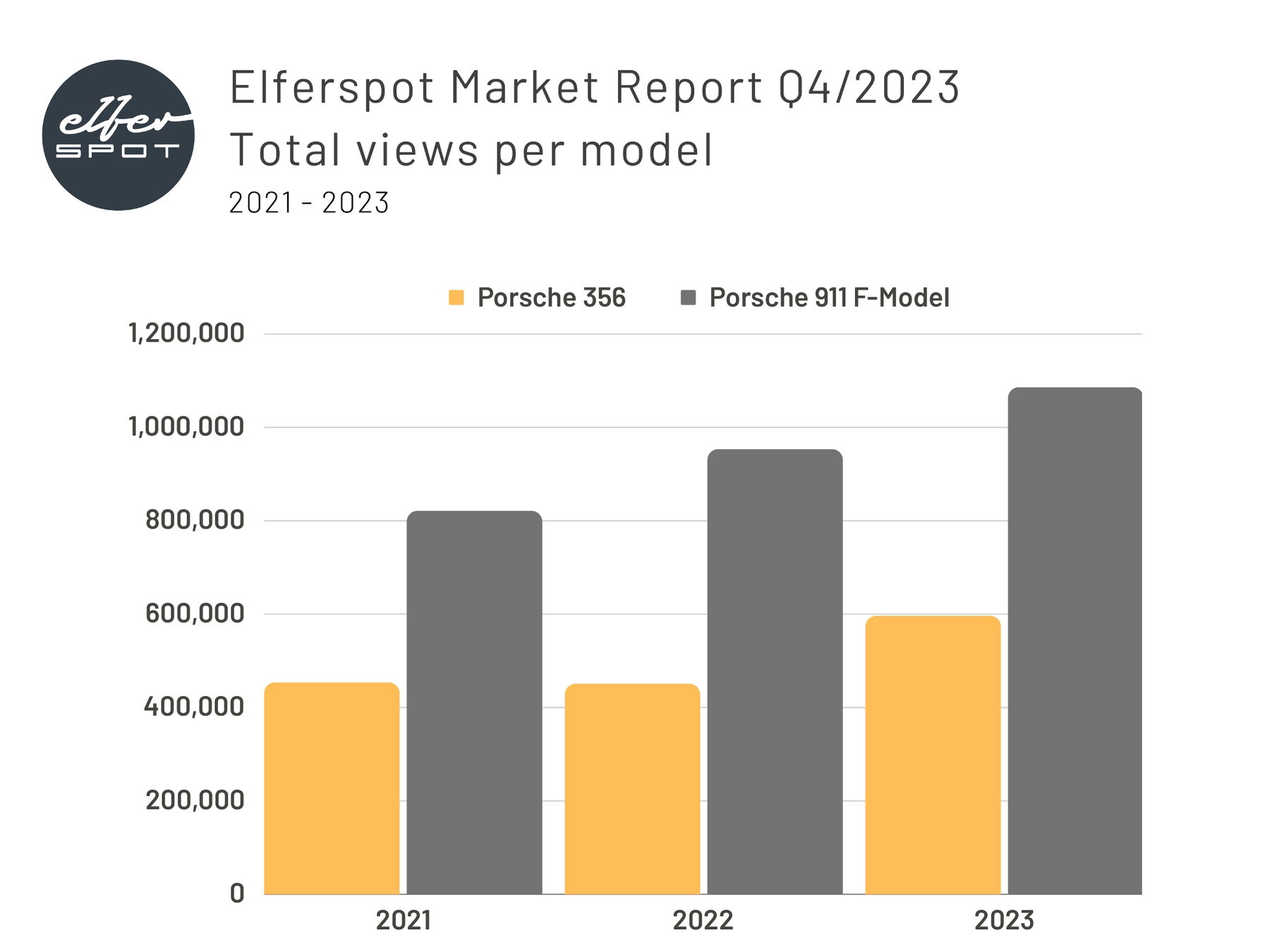

Porsche’s first mass-produced car, the 356, has consistently ranked in the top 10 in terms of total views since Elferspot was founded in 2017. And that puts it in good company. The Porsche 930 and 996 are on a comparable scale with around 600,000 ad impressions last year. After a little breather in 2022, it gained another 30% in total impressions in 2023.

The original Porsche 911 traditionally ranks ahead of the 356 in terms of clickrates. It is just shy of the 911 Backdates and the current 992 generation. With more than one million hits on advertisements for the first generation 911, it is in 8th place overall in the ranking. This is a very respectable figure in view of the relatively small production numbers and therefore also the smaller quantity on offer.

Although the F-model does not quite reach the same attention as the 993, G-model, 964 and 997, which all have between 1.7 and 1.9 million clicks, it is noticeably ahead of the 930 Turbo. Incidentally, the 70’s wildest 911 also has to admit defeat to the Porsche 356. Interest in Porsche’s oldest models therefore remains high.

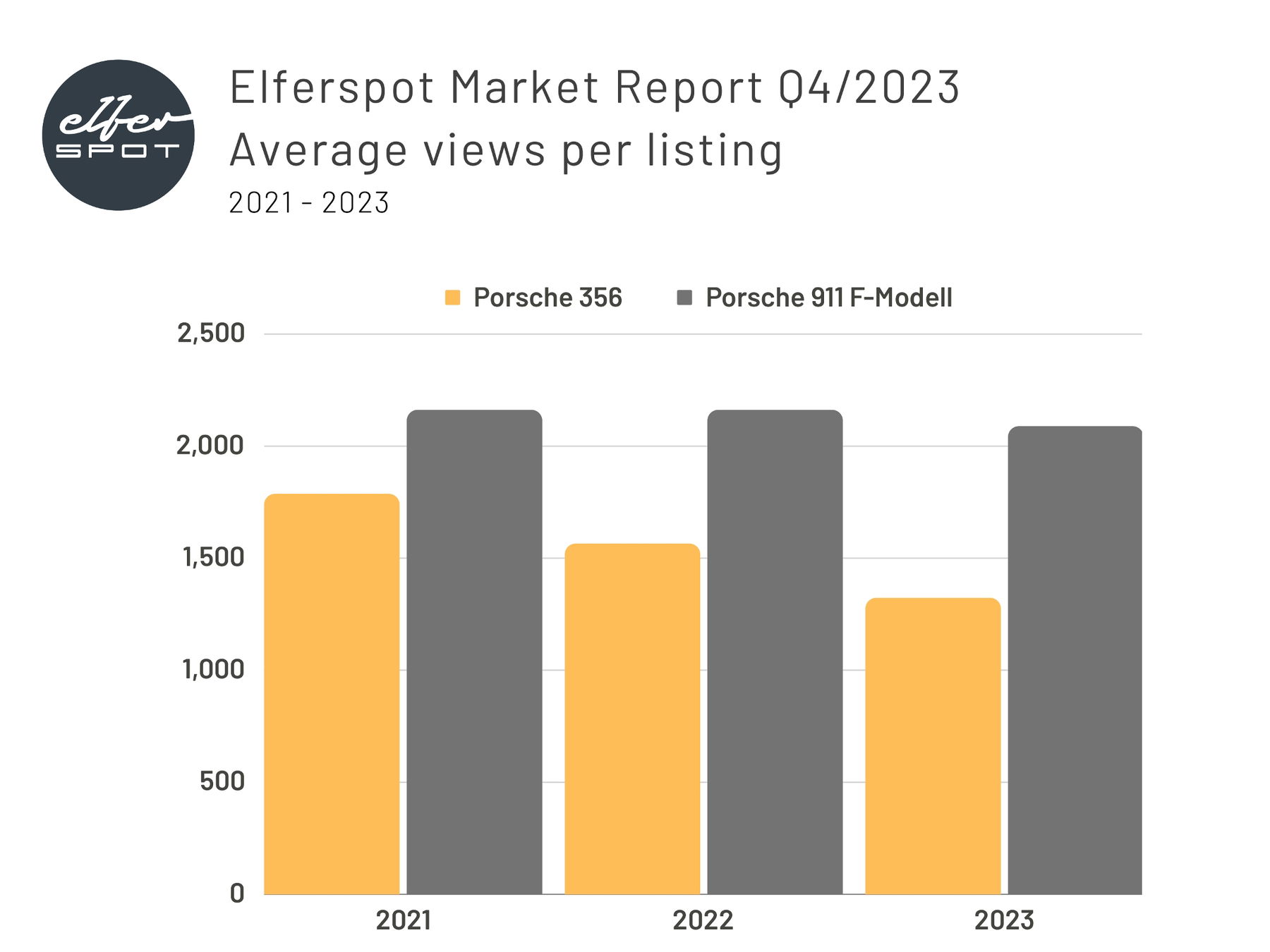

On closer inspection, it is noticeable that the number of views per listing for the 911 F-model is stable, while the 356 is in slight decline. Of course, this also has to do with the number of vehicles on offer. While there were 254 Porsche 356s on offer on Elferspot in 2021, 451 examples landed on our platform in 2023. So the offers almost doubled.

Between 2020 and 2022, many people fulfilled their dream of owning a classic Porsche sports car. Demand sometimes exceeded supply. In 2023 though, demand fell again slightly. Shifting interests, a slowing economy and changes in banks’ interest rate policies made liquidity more attractive again. It is therefore not surprising that more cars were offered on the market again last year.

As a result, there is naturally also more choice. The quality of the offer is therefore becoming increasingly important. However, both the Porsche 356 with an average of 1,323 clicks per listing and the 911 F-model with 2,089 clicks per vehicle are still at a high level. By comparison, the Porsche 991 and 992 (see Market Report Q3/2023) were in the region of 1,500 clicks per listed car. So the interest is still there, but the competition is greater than in previous years.

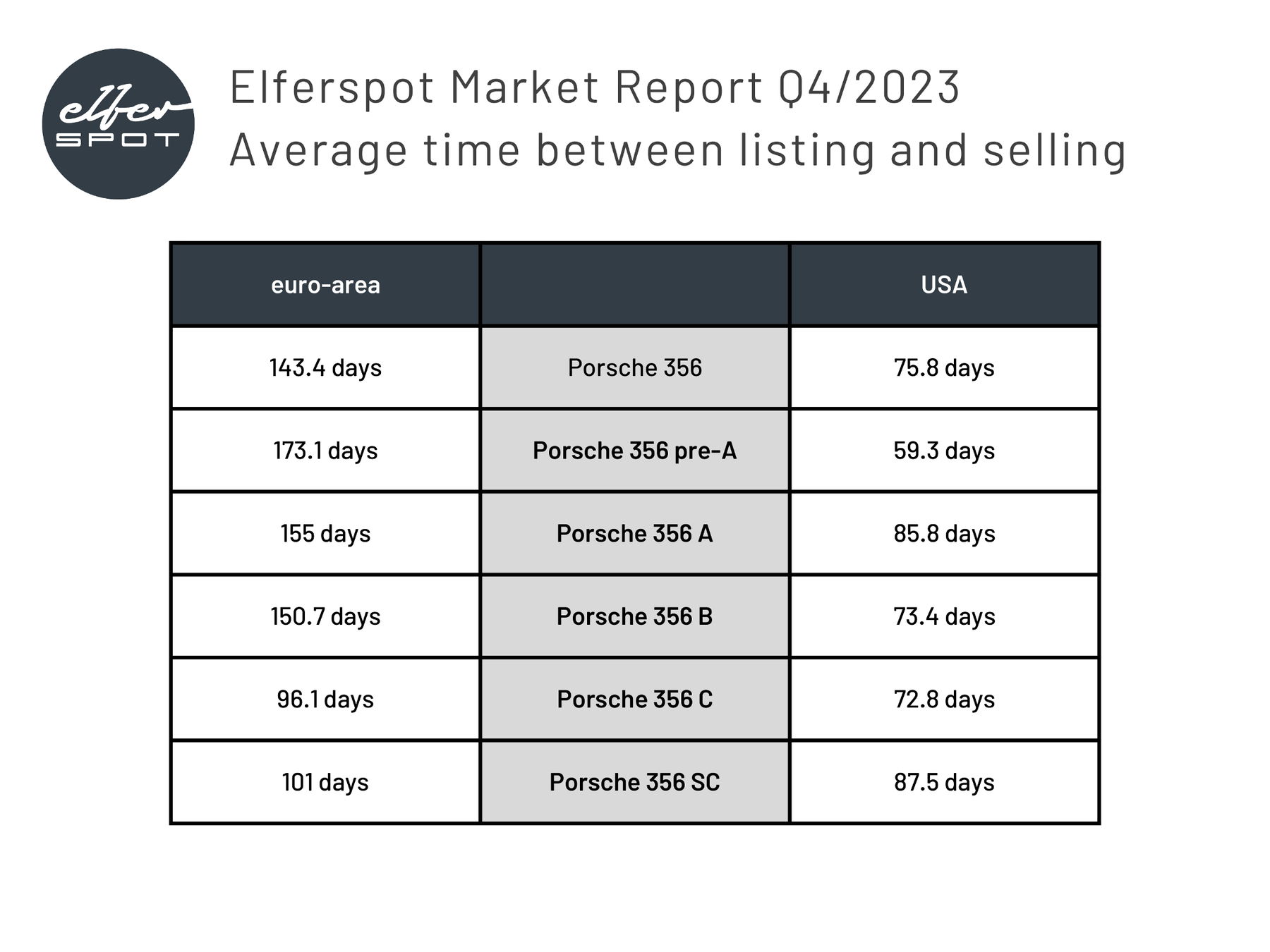

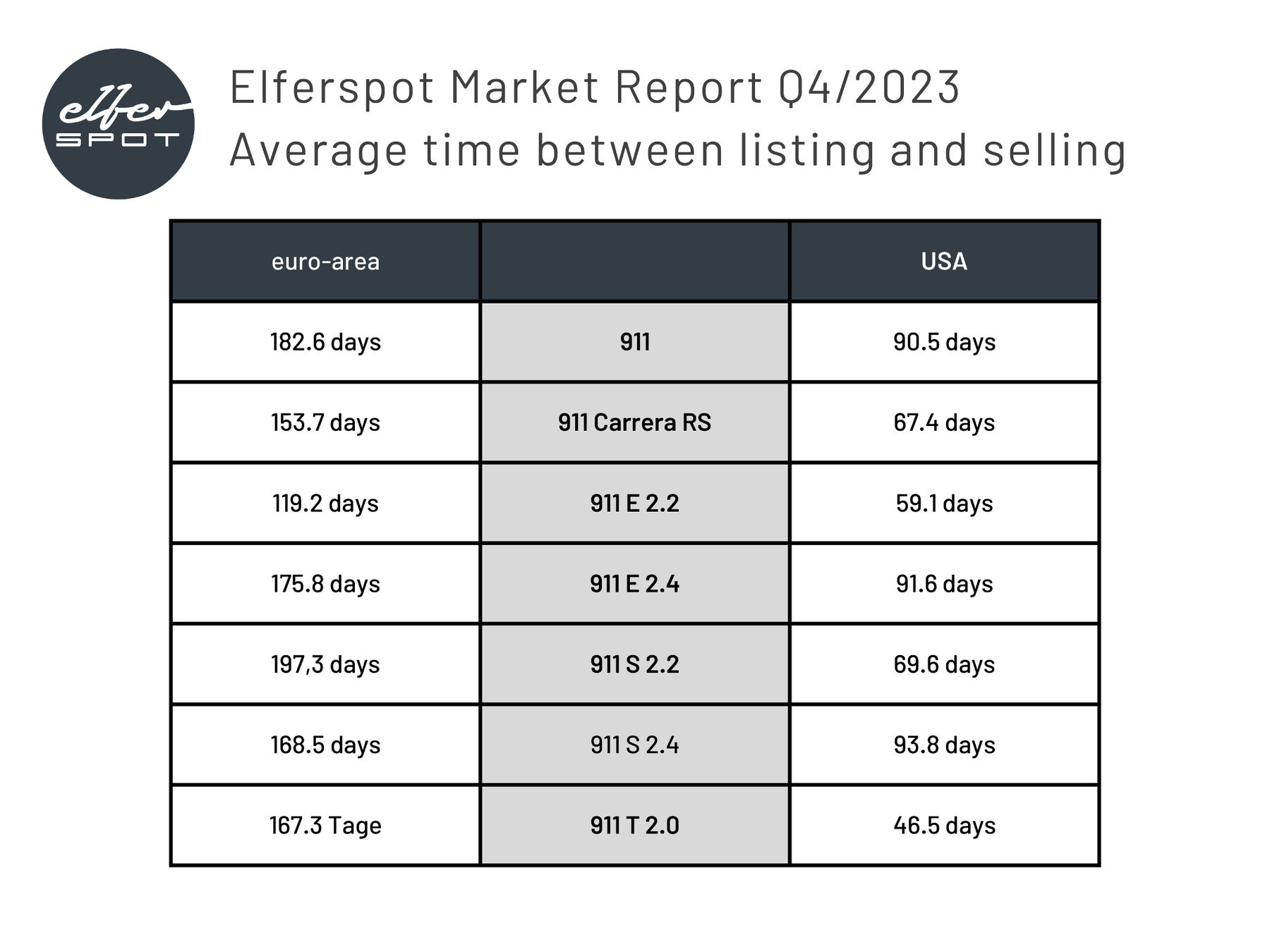

As already indicated in the previous Market Report for Q3/2023, the holding time before sale is a good indicator of market activity. Keeping an eye on and maintaining this data also makes it easier to plan your own liquidity. It is noticeable that these classic vehicles often remain advertised for longer before they find a buyer.

Of course, the Porsche 356 and 911 F-model have long been sought-after classics. These vehicles have relatively little to do with the typical used car business. That is why selling them is also more time-consuming. After all, there are fewer potential customers than for a new 911 that is to be leased as a company car, for example. The appraisal of such old vehicles also requires more expertise in order to be able to certify originality.

What is surprising, however, is the big regional difference. While Porsche 356s in Europe tend to find a new garage after four to five months, it only takes half the time in the USA. This finding also applies to the 911 F-model. Here, too, the differences are in the same range. It takes around six months to sell an original 911 in Europe and around three months in the USA.

Such big differences are surprising, but can be explained on closer inspection. This is because American buyers tend to have a different mentality. While customers in Europe often demand extremely precise expert reports on the condition of classic vehicles, the culture of US buyers is often a little more relaxed. Originality isn’t as important in America, as people proudly modify their classics over there anyway. In addition, the dollar generally sits somewhat looser than the euro.

However, the car culture in the USA also provides evidence as to why vehicles are sold more quickly there. Due to the often drier climate than in Europe, sports cars – even classics – are driven much more than in Europe. In California, there are plenty of car and Porsche meets every single week. The scene in the States is more active and open than in Europe.

After the extreme bull markets of 2020 and 2021, the prices for classic Porsche sports cars didn’t go up all the time from 2022 onwards. Nevertheless, the Porsche 356 developed positively across almost all model series. The exceptions in Europe were the Porsche 356 B and 356 SC. In the USA, mainly the 356 B.

| 2021 | 2021-2022 | 2022 | 2022-2023 | 2023 | 2021-2023 | |

|---|---|---|---|---|---|---|

| 356 | $203.055,00 | -26,78% | $160.164,00 | 36,83% | $253.535,89 | 19,91% |

| 356 pre-A | $743.750,00 | -242,35% | $217.250,00 | 37,02% | $344.940,00 | -115,62% |

| 356 A | $248.307,00 | 6,05% | $264.300,00 | 16,23% | $315.525,00 | 21,30% |

| 356 B | $189.698,19 | -75,87% | $107.860,00 | 34,90% | $165.674,00 | -14,50% |

| 356 C | $113.918,75 | -3,46% | $110.108,00 | 59,63% | $272.750,00 | 58,23% |

| 356 SC | $99.111,11 | 1,49% | $100.612,00 | 44,95% | $182.752,00 | 45,77% |

The very specific outliers in the Porsche 356 pre-A models in the USA distort the picture somewhat. However, a generally higher volatility of asking prices is noticeable. While the late 356 C models in particular were extremely popular with American buyers, the 356 B experienced a rollercoaster ride. An average fall of over 80,000 US dollars was followed by a rise of almost 60,000 dollars the following year. However, the 356 A and SC rose noticeably in price in 2022 and 2023. (Note: Of course, extremely special and high-priced vehicles have a high impact on average prices due to the low number of units, but the trend remains).

Fluctuations for the first Porsche 911 are less pronounced – especially in Europe. Almost all models show a positive price trend here, mostly in the single to low double-digit percentage range over the past three years. The Porsche 911 Carrera RS is an exception here, with a slightly negative trend since 2021. However, the sample size is naturally smaller. In addition, accident damage or different mileages, for example, nominally mean significantly greater price differences for such high-priced collector’s vehicles.

| 2021 | 2021-2022 | 2022 | 2022-2023 | 2023 | 2021-2023 | |

|---|---|---|---|---|---|---|

| 911 2.0 | 182.787,00 € | 4,21% | 190.817,50 € | 12,45% | 217.947,00 € | 16,13% |

| 911 Carrera RS | 660.000,00 € | 15,61% | 782.102,00 € | -23,64% | 632.568,00 € | -4,34% |

| 911 E 2.0 | 116.684,00 € | -4,30% | 111.870,00 € | 8,37% | 122.084,00 € | 4,42% |

| 911 E 2.2 | 100.482,00 € | 1,13% | 101.635,00 € | 18,04% | 124.002,00 € | 18,97% |

| 911 E 2.4 | 118.329,00 € | -6,20% | 111.426,00 € | 6,25% | 118.852,00 € | 0,44% |

| 911 L | 103.270,00 € | -3,33% | 99.940,25 € | 20,18% | 125.210,00 € | 17,52% |

| 911 S 2.0 | 200.627,00 € | 2,31% | 205.376,45 € | 2,45% | 210.534,00 € | 4,71% |

| 911 S 2.2 | 175.638,00 € | 0,33% | 176.228,17 € | 1,30% | 178.541,00 € | 1,63% |

| 911 S 2.4 | 176.823,00 € | 3,87% | 183.943,26 € | -0,01% | 183.921,00 € | 3,86% |

| 911 T 2.0 | 74.996,00 € | 28,45% | 104.822,00 € | 6,41% | 112.006,00 € | 33,04% |

| 911 T 2.2 | 90.880,00 € | 4,59% | 95.256,00 € | -1,99% | 93.398,00 € | 2,70% |

| 911 T 2.4 | 105.918,00 € | 5,76% | 112.386,00 € | -0,94% | 111.340,00 € | 4,87% |

Die größten Gewinner der letzten Jahre sind in Europa das Urmodell mit 2,0 Liter Motor, der 2,2 Liter 911 E sowie die frühen 911 T mit dem kleinen 2,0 Liter Motor. Sie verzeichneten 16, 17,5 und 33 Prozent Wertzuwachs seit 2021.

| 2021 | 2021-2022 | 2022 | 2022-2023 | 2023 | 2021-2023 | |

|---|---|---|---|---|---|---|

| 911 2.0 | $134.856,00 | 34,21% | $204.980,00 | -25,81% | $162.927,00 | 17,23% |

| 911 Carrera RS | $490.000,00 | 61,06% | $1.258.333,00 | -43,20% | $878.750,00 | 44,24% |

| 911 E | $163.039,00 | -18,38% | $137.725,00 | 4,67% | $144.470,00 | -12,85% |

| 911 S 2.0 | $297.705,00 | -0,42% | $296.461,00 | -2,21% | $290.045,00 | -2,64% |

| 911 S 2.2 | $194.879,00 | -5,00% | $185.600,00 | 1,01% | $187.500,00 | -3,94% |

| 911 S 2.4 | $202.237,50 | 6,14% | $215.464,00 | -0,29% | $214.841,00 | 5,87% |

| 911 T 2.4 | -* | – | $98.125,00 | 21,08% | $124.332,00 | – |

| 911 T 2.2 | $104.291,00 | 2,33% | $106.779,00 | 8,98% | $117.312,00 | 11,10% |

As with the Porsche 356, prices for 911 F-models fluctuated more in North America than in Europe. This is particularly noticeable with the Carrera RS and the early 2.0 liter original 911. Here, the fluctuations ranged from 25 to over 60 percent. While the 911 E and the first two generations of the 911 S with 2.0 and 2.2 liter engines stagnated at a high level or fell slightly in price, the 911 T moved closer to its more luxuriously equipped and more expensive siblings.

Our analysis shows that trading in classic Porsche sports cars requires a little more patience than with newer cars. In contrast to modern vehicles such as the Porsche 991 and 992, which are often sold within a month, the 356 and 911 F-models sometimes stay at the dealers for a few months. However, it is also true here that good vehicles with the right price quickly find a new home.

The gold-rush mood of 2020 and 2021 has subsided somewhat. Nevertheless, the value of historic vehicles from Zuffenhausen remains at a high level. So there can be no talk of a crash in this market segment. Especially as the average time between listing and selling these vehicles has not increased significantly in recent years. In plain language, this means that a good car sold just as quickly in 2023 as it did in 2021.

Elferspot magazine